does cash app charge international fees

Bank-to-bank transfers with Cash App are free. Instead most of its services are free of cost instead of a couple in which you are liable to pay the associated fee.

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method

Since Cash App does not offer international transfers you will need to find another option if you need to send or receive money from another country.

. Cash cards work at any atm with just a 2 fee charged by cash app. Does cash app accept international cards. When you send a payment outside the UK Cash App will convert the payment from GBP to USD based on the mid-market exchange rate at the time the payment is created and your recipient will receive the funds in USD.

International Transfers. Unfortunately Cash App doesnt work internationally it only works in the US and the UK. What fees does Cash App charge.

You can now send or request Cash App payments with friends located in the US. However they do charge the following fees. Cash App isnt available internationally outside the United States and the United Kingdom.

It isnt even available in neighboring Canada and there are no plans for Cash App to expand on an. Cash App charges 3 of the transaction to send money via linked credit card. Cash App international alternatives.

Cash App doesnt charge foreign transaction fees for using your Cash Card for purchases in or from other countries. Cash App isnt an expensive or bank-breaking platform. Cash App charges a 3 on money transfer via credit card 15 of the total amount on instant funds transfer 2 to 3 fee on cryptocurrency and 2 on per ATM withdrawal.

Cash App Support International Payments. This is a fairly standard fee compared with other money transfer apps. Cash App does not work internationally.

Cash App is so popular in the US that many people around the world are wondering if Cash App is available internationally in their countries. When you send money to another user you pay them through PayPal. However if you need to send funds instantly you can pay a rush fee of 15 of the transfer amount.

Alternative Options for International Money Transfers. Cash App uses the current mid-market exchange rate for international payments which is determined by the current buy and sell rates with no additional fee included by Cash App. Cash App is one of the most famous US fintech companies that allows users to send and receive money instantly and for free.

If you have a debit card or bank account linked to your Cash App you wont pay any fees to receive or send money. 98 currencies available to transfer to 130 countries. There are also fees to pay when you use the Cash App card including a 2 USD charge per ATM withdrawal⁴.

Then after you send the money PayPal charges the recipients bank account. Cash app charges 3 of the transaction to send money via linked credit card. Not so much as a peep has been made from Cash App regarding international transfers beyond the United States and UK.

Cash App charges 2 and youll pay any fee charged by the ATM operator outside of the Visa network. Cash App Costs and Fees. ATM fees are reimbursed if you have at least 300 per month in direct deposits.

According to the Cash App Help page the service does not currently support payments to international recipients This means if you are living in the US. When you use your debit card or bank account to make a payment Cash App does not charge you any fees. Here is when Cash App charges a fee.

If you transfer someone 200 using the Cash App and your connected credit card youll be charged 206. Cash App will provide the exchange rate on the payment screen before you complete it. Most atms will charge an additional fee for using a card that belongs to a.

Every time you use your credit card to send money Cash App will charge you a 3 fee. Venmo for example also charges 3 to. But if youre sending money with a credit card.

Typically Cash App transfers take about 2-3 days to be completed like a regular bank transfer. There are no fees to send or request payments outside your region using Cash App. There are no fees to send or request.

August 28 2021. Cash App charges a fee for instant transfers 05 to 175 of the transfer amount with a minimum fee of 0. You can also learn more about other Cash App fees here.

What Fees Does Cash App Charge. 11 rows Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. When you send money to someone else you must sign up for PayPal.

You can expect to pay these fees. There are no fees charged by Cash App when you send money to other people. Its processing fee is also quite small and the money gets deposited in the recipients account after 24 hours.

Cash App Rewards Money Transfer App Money Generator

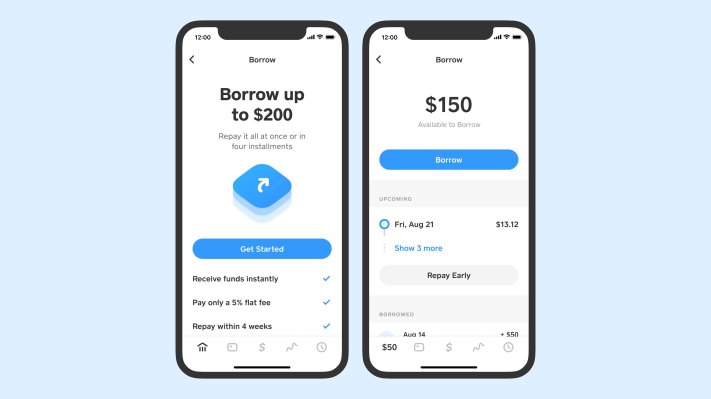

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Can You Use A Credit Card On Cash App Learn How To Link Your Debit Or Credit Card Here

Cash App International Transfers Uncovered Transumo

How To Get Free Money On Cash App Gobankingrates

What Does Pending Mean On Cash App Learn All About The Cash App Pending Status Here

/images/2020/10/01/happy-woman-sending-text-message.jpeg)

Cash App Review 2022 Is It A Safe Way To Send And Receive Money Financebuzz

:max_bytes(150000):strip_icc()/01_Cash_App-c8b5e0e13c9d4bc09b0c1f0c07f43bd5.jpg)

How To Use Cash App On Your Smartphone

:max_bytes(150000):strip_icc()/02_Cash_App-3f22fbebe8884a73b04ca583f1baa7bf.jpg)

How To Use Cash App On Your Smartphone

Can You Send Money From Zelle To The Cash App A Complete Guideline

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Paypal Vs Google Pay Vs Venmo Vs Cash App Vs Apple Pay Cash Digital Trends

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

:max_bytes(150000):strip_icc()/03_Cash_App-facb0d3923c14a1c9e5195adfe4953cf.jpg)

How To Use Cash App On Your Smartphone

Cash App Taxes 2021 Review New Name Same Free Tax Experience Tom S Guide

How To Add Money To Your Cash App Or Cash Card

Paypal Vs Google Pay Vs Venmo Vs Cash App Vs Apple Pay Cash Digital Trends

/Screenshot2021-11-09at11.35.14-7476aa727d4c4dae82727b2800eb6234.jpg)